Ten global issues to shape mining and metals markets in 2026

Read the full article here.

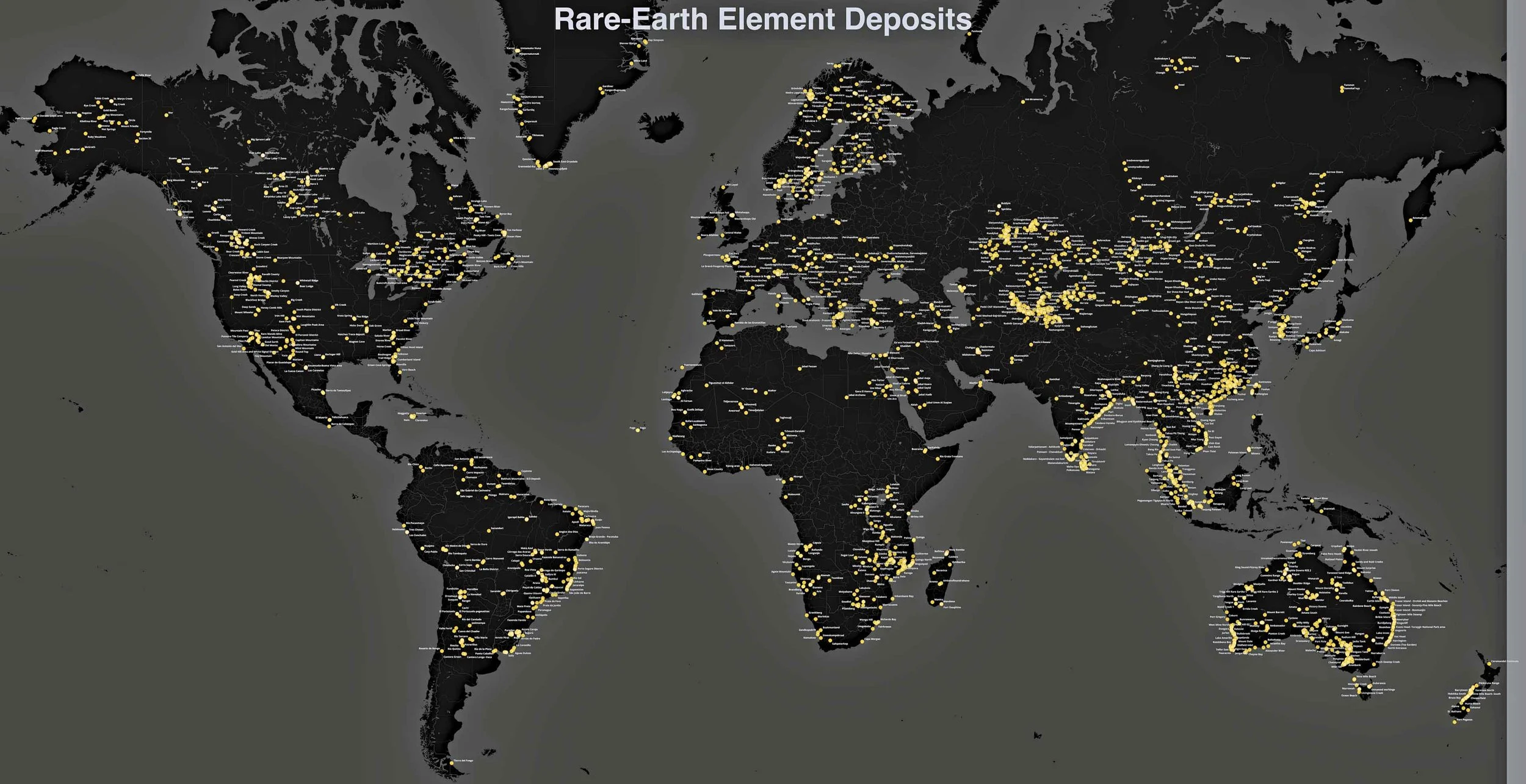

Western governments with high reliance on critical mineral supply from geopolitical adversaries – mainly China – are likely to step up circularity initiatives in mining value chains in 2026. Sustained trade tensions underscore the clear frailties to supply disruptions, especially for automotive, manufacturing, defence and technology sectors in the EU and India. For example, several European automotive firms were forced to halt production and implement layoffs due to escalating US-China trade restrictions on rare earths throughout 2025. Similarly, an electric automotive manufacturer in India halved its output of electric scooters due to rare earths shortages.

The viability of government circularity targets relating to critical minerals is aided by the narrowing gap in the economics of recycling versus primary raw materials. In cases where scale and logistical connectivity can be maximised, scrap aluminium and steel can be significantly cheaper than primary material. The hard part remains efficient collection and sorting, which can fluctuate wildly. Indeed, the vast majority of end-of-life metal still ends up in landfill, where it is often too costly to retrieve and process competitively. But recycling still has one major thing going for it: margins are generally more predictable as scrap markets tend to display narrower price volatility, even if they do track primary commodity price swings.

The EU on 3 December announced plans to restrict exports of rare earth waste and battery scrap from early 2026. The UK’s November Critical Mineral Strategy also announced plans to recycle 20% of critical minerals by 2035. India, through its National Critical Mineral Mission, will launch an incentive programme to boost recycling between 2026-31.

Source: Wikipedia